2020 is behind us at last. It was a year of ups and downs that found some businesses soaring and others ducking for cover.

Companies that distribute items deemed essential saw their businesses explode and struggled to handle the volume increases. Those that distribute items considered non-essential had to find creative ways to keep the lights on.

A Year of Consumption Shifts

In 2020, a large chunk of consumption shifted from outside to inside the home under coronavirus lockdowns and social distancing. Certain consumer product segments were pushed to the fore, especially those viewed as essential, such as packaged foods and home care items. Online retailers, like Amazon, were among the biggest winners of the pandemic, as people grew cautious about leaving their homes. Big-box stores, such as Walmart, Target, and Costco, also experienced success, as shoppers flocked to stores where they could get all their shopping done in one go or take advantage of curbside pickup. According to CNN, in the first three quarters of the year, “sales increased 7% at Walmart, 12% at Costco, and 19% at Target.”

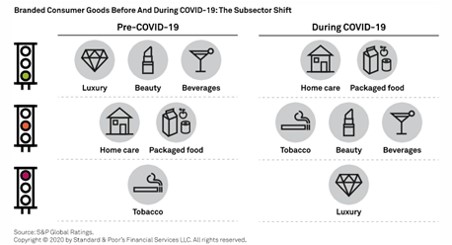

As the pandemic winds down, S&P Global Ratings projects that demand for staple goods will continue to grow at a robust pace, while luxury goods and prestige beauty will struggle. “Before the pandemic, staples had suffered from low growth, and some global brands were battling to stay relevant in the eyes of consumers. At the same time, luxury goods and prestige beauty grew rapidly, fueled by an upswing in global travel and demand from Chinese consumers, both at home and abroad.”

COVID-19 has led to a sharp turn of fortunes across the different segments of the consumer goods sector.

Winners and Losers Both Need to Step Up Their Labor Management System

Whether your organization saw demand explode or recede, one thing rings true from a distribution perspective: there’s a need for improved labor management.

According to Evan Danner, CEO at TZA, “In cases where volume was exploding, companies were challenged to determine how many people they needed, when they needed them, and how to make their people as productive as possible. They did whatever they could do just to keep up.” As a result, these companies experienced many of the things that often come with inadequate labor management – excessive overtime, a decline in productivity, and an increase in turnover – but at a much higher level.

On the flip side, non-essential type businesses that struggled in 2020 had to reduce their staff and maximize their remaining resources’ productivity levels. With labor costs accounting for 50% to 65% of a distribution facilities’ operating budget, these organizations had to get creative and do more with less.

But it isn’t just exploding or imploding demand that is driving the need for improved labor management – it’s the continued struggle to find labor. According to Danner, “For the last five to ten years now, there hasn’t been a lot of available labor on the market. Successfully recruiting labor, and more importantly retaining that labor, will continue to be a major focus for organizations in 2021.”

If you’re wondering if you have retention issues and what you can do to address them, look out for our new Q&A – 2021: The Year of The Labor Management System System. We will dive deep into your most pressing questions on the competitive labor market, employee retention, and how Labor Management System Systems can help.